The Bahamas intends to lower the value-added tax rate from 12 percent to 10 percent, the territory announced in its supplementary 2021/22 Budget, released on October 27.

The rate cut is to be accompanied by a narrowing of the scope of the VAT zero rate, with the precise scope of the measure to be announced subsequently. Instead, targeted welfare payments will be made to the territory’s lowest-income households.

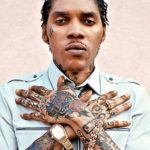

Delivering the Budget, Philip Davis, the country’s Prime Minister and Finance Minister, said: “The Ministry of Finance team has worked long hours, along with some of the brightest minds at the University of The Bahamas and the Government and Public Policy Institute, as well as with international consultants, to perform extensive modelling and financial analysis to ensure that the VAT reduction does not adversely affect our fiscal position. With the reduction in the VAT rate, we are eliminating the zero-rating under VAT on a variety of items. Price controls are in place to ensure breadbasket items will be fairly priced. The VAT exemption for electricity bills and the special economic zones are untouched.”

He added that the territory is aiming to generate BHD200m (USD200m) in two years through the creation of a Revenue Enhancement Unit, which will focus on challenging tax avoidance and fraud. Mike Godfrey, Lowtax.net, Washington